Rules for conducting primary market research in India

Planning to conduct a primary market research study in India and are confused about how to conduct it?

What are the things to keep in mind while conducting market research in India?

Are you finding issues with your data due to the under-representation of sample coverage?

In my market research career, I have received requests for a proposal (RFQ) for small sample size for India which I find highly inappropriate.

I consider the limited knowledge of the Indian market as the primary reason for such a request.

This article details the guiding rules for planning market research in India

Background

India is the second-most populous country in the world and the fifth-largest economy in the world by GDP.

Also, India is one of the fastest-growing economies, with a large youth population, has gained global competitiveness and economic influence in recent years. This has lead to an increase in Foreign Direct Investment (FDI) in India.

The diversity of India is a challenge for marketers. Let’s have a look at the rules that will enable designing your primary market research framework for a country like India.

Rule 1#Have representation of major states

India is the 7th largest country in the world with a total area of 3,287,263 square kilometers.

There are 29 states and 7 union territories in India

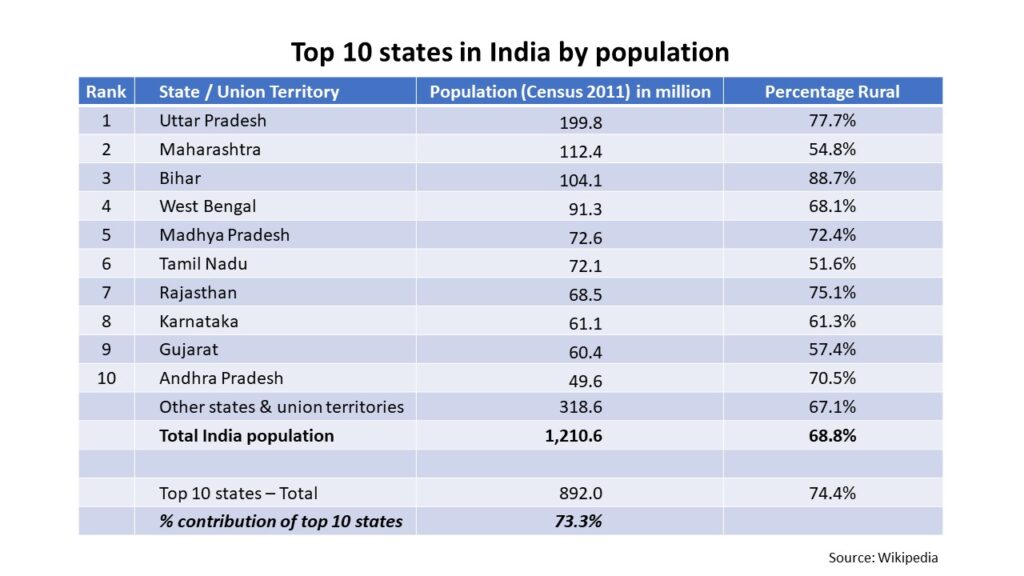

The top 10 states by population are:

While conducting primary market research, do ensure to have a representation of major states.

The majority (69%) of the Indian population is based in rural areas.

Hence, have a representation of urban and rural sample based upon your study objectives

Rule 2#Ensure representation across various town class

Census of India has categorized the population into 6 tiers:

- Tier-1: 100,000 and above

- Tier-2: 50,000 to 99,999

- Tier-3: 20,000 to 49,999

- Tier-4: 10,000 to 19,999

- Tier-5: 5,000 to 9,999

- Tier-6: Less than 5000

There are 461 Urban Agglomerations (UA)/Towns in Tier I as per Census of India 2011.

53 cities have more than 1,000,000 population in India.

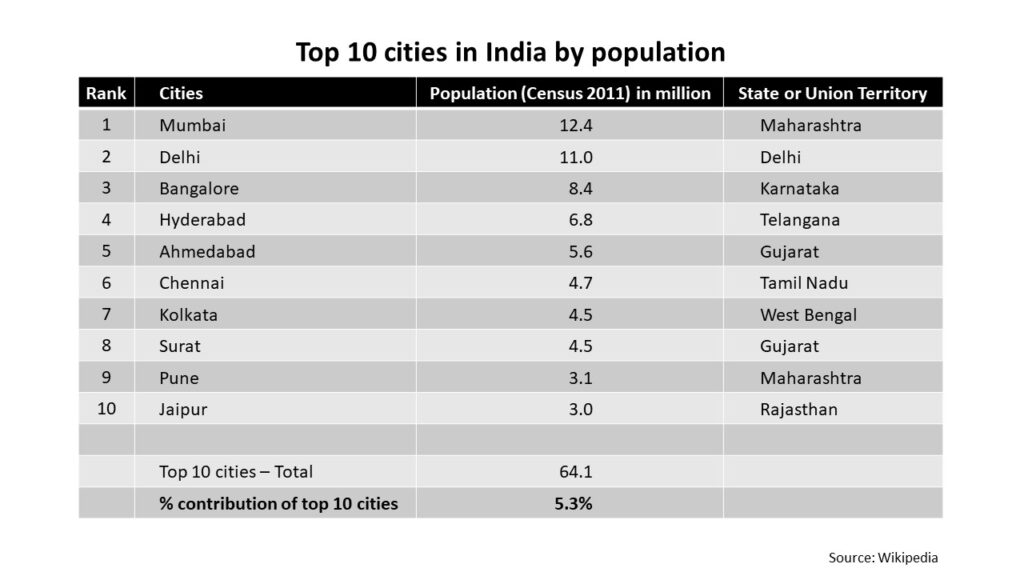

The top 10 cities by population:

You can plan your sample across various:

- Zones – North, South, East & West

- Within each zone select a city/cities across:

- > 1 million population

- 1 mill. to 1 mill. population

- < 0.1 mill. population

Rule 3#For primary market research have a criterion of Socio-Economic Classification

Indian consumers are classified by the Socio-Economic Classification (SEC).

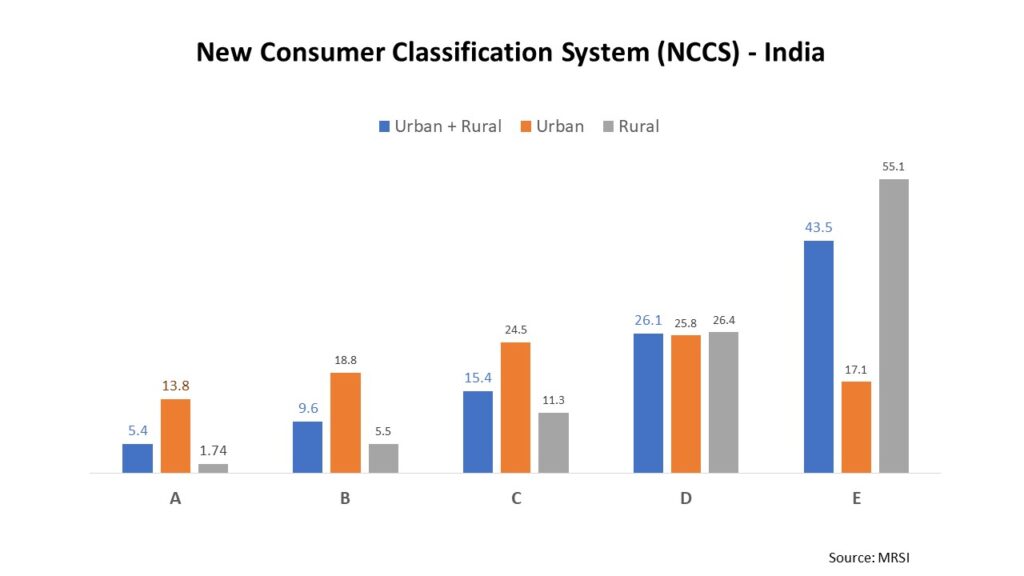

Market Research Society of India (MRSI) has revised the Socio-Economic Classification (SEC) to New Consumer Classification System (NCCS).

The NCCS is a unified system to categorize both urban and rural consumers.

NCCS takes into account:

- Durables used at home (owned/provided by the employer/available in the house)

- Ownership of agricultural land

- Education of the person who makes the biggest contribution to the running of the household

Rule 4#Access ease of recruitment of target group

Surveys can be conducted easily among males and housewives.

While conducting surveys with working women, specific category users, etc. do check feasibility and ease in recruitment

Rule 5#Have an adequate sample size

Do ensure there is no under-representation of the sample frame.

You can have a minimum sample at the city/zone level.

Low sample size will result in under-representation of cities/tier/zone, etc and you are may have some data inconsistencies

Rule 6#Select appropriate interviewing methodology

The majority of the primary market research surveys are conducted face to face.

COVID has led to a spike in online interviews and usage of consumer panels.

You can conduct telephonic interviews if the interview length is less than 15 min.

Rule 7#Check on the data capture methodology

Quantitative face to face interviews is majorly conducted using Android tablet.

However, when the sample size is small, you can conduct the interview using pen and paper methodology

Rule 8#Have questionnaire translation in place

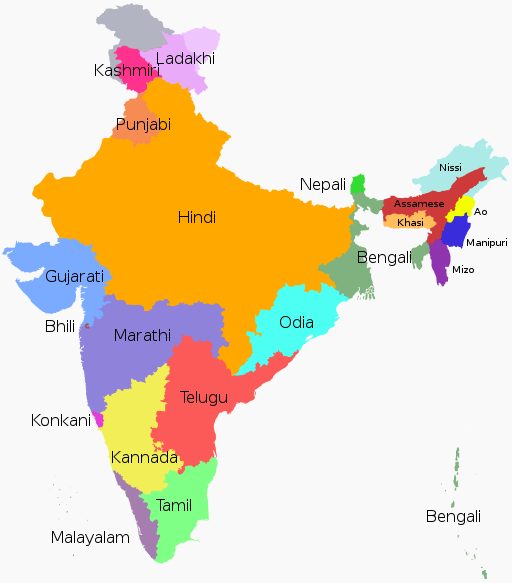

There are 22 major languages in India (Census 2001)

These languages vary by state/geography.

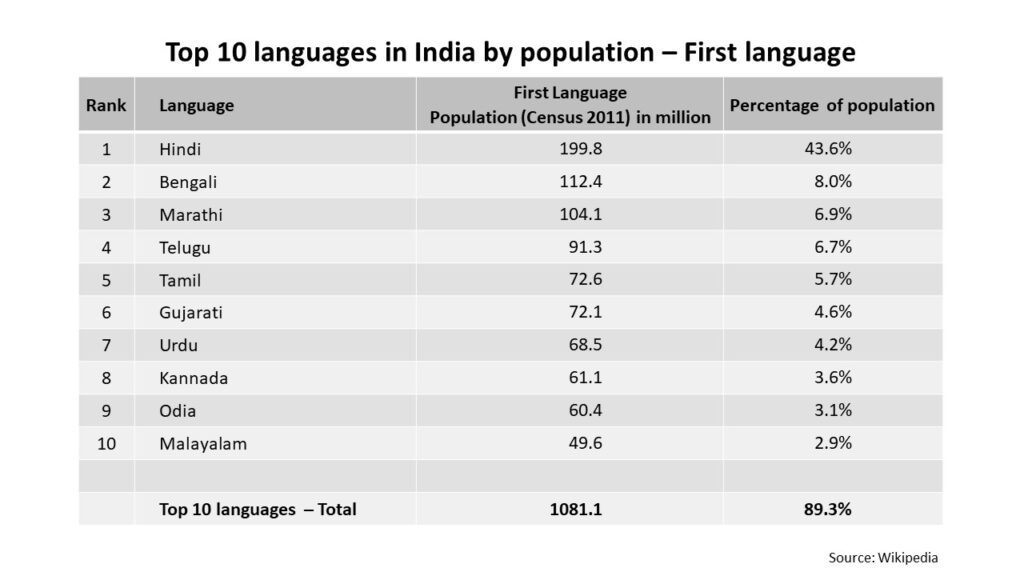

Top 10 languages by number of native speakers

English is a primary language among ~0.02% of the population.

However, at a combined level (first, second & third language), English is spoken by ~ 10.67% of the population.

The market surveys can be conducted in English in the major cities primarily among the upper strata of the society.

You should conduct surveys in their native language while reaching out to consumers in semi-urban, rural or lower strata.

Ideally, let the respondent respond in English or native language as per their convenience.

Rule 9#Budget time for translations

Get the translations from reliable sources.

Although Hindi is spoken by ~ 57% of the population (first, second & third language), the commonly used words should be included.

Hindi is spoken in Bihar, Delhi, Haryana, Jharkhand, Madhya Pradesh, Rajasthan, Uttarakhand, and Uttar Pradesh.

Some words that are specific to the state may not be used in another state. Example – terms used in the state of Uttar Pradesh may not be used in the state of Bihar or other states. Hence, use words that are understood across geographies.

If the survey involves some category nuances, get the translation checked by a subject knowledge expert from the respective state.

Do budget time for translations & back translations.

Rule 10#Pilot the questionnaire

Do pilot the questionnaire before the formal launch.

If there is a questionnaire already in place, revalidate it and check for suitable words and phrases based upon the context.

Also, if you are having a scale question, evaluate the scale suitable for the context.

Rule 11#Be sensitive to the cultural nuance

While conducting home visits be sensitive to cultural nuance.

Understand the consumer in the following context:

- Religion

- Eating habit – vegetarian / non-vegetarian

- Dressing etiquette

- Home etiquette & customs (variation by state)

- Joint family or Nuclear family and family hierarchy

- Social strata (especially in semi-urban & rural context)

Rule 12#Be conscious about the festivals and holidays in India

India celebrates numerous festivals.

The 3 mandatory national holidays in India are:

- Republic Day (January 26th)

- Independence Day (August 15th)

- Gandhi Jayanti (October 2nd)

Major Hindu festivals in India:

Diwali, Dussehra, and Holi are the major festivals.

The festivals vary by zone and state.

The major festivals celebrated by Hindus (month wise) are:

- Makar Sankranti – Kite Festival in Gujarat and Lohri in North India (January)

- Pongal Harvest in Southern Part of India (January)

- Kumbh Mela (once in 3 years)

- Maha Shivratri (February)

- Holi (March)

- Mahavir Jayanti (April)

- Buddha Jayanti (May)

- Rath Yatra Orissa (June)

- Rakshabandhan (August)

- Janmashtami (August)

- Ganesh Chaturthi – Maharashtra (September)

- Onam: Kerala (August – September)

- Durga Puja (October)

- Navratri (October)

- Dussehra (October)

- Diwali (October /November)

Major Muslim festivals in India:

- Eid ul-Fitr: month-long fasting (June)

- Id ul Zuha/Bakrid (August)

- Muharram (August)

Christmas is celebrated on 25th December and it is a public holiday in India.

If you are planning your visit to your business associates or visit the marketplace do confirm on the weekdays and weekly off. These may vary by city/location with the city.

Summary

These rules will enable you to design/plan for a suitable survey in India.

While planning for Market research activities do check on the festivals during the survey duration.

Be realistic on the timelines. A crunched timeline is likely to impact the quality of data collection.

Do reach out to reliable sources while planning your market research in India.

Connect with us for your market research requirement